I. Identification of the Housing Unit Count for Loan

1. Where the employees who make the contribution have no housing in Shanghai in the name of their family, have not utilized the individual housing loan from the housing provident fund nationwide, or have settled the first individual housing loan from the housing provident fund, the loan to them shall be identified as the first home loan. Where the employees meet the conditions for loans for indemnificatory housing with shared property rights from the housing provident fund in Shanghai, the loan to them shall be identified as the first home loan.

2. Where the employees who make the contribution have a housing unit in Shanghai in the name of their family, have not utilized the individual housing loan from the housing provident fund nationwide, or have settled the first individual housing loan from the housing provident fund, the loan to them shall be identified as the second improved housing loan.

3. No loan shall be granted to the family of the loan applicant or joint loan applicant, if:

(1) With outstanding individual housing loans from the housing provident fund nationwide;

(2) With two or more records of individual housing loans from the housing provident fund nationwide;

Loan disbursement to families of the loan applicants who purchase a second non-improved housing unit, a third housing unit or more shall be ceased.

4. Requirements for identifying the housing unit count in terms of the application for housing provident fund loans for housing purchased for marriage:

If the borrower or his or her spouse jointly owns no more than one house with shared property rights with their respective parents before marriage (that is, either of the borrower and the borrower’s spouse jointly owns one house with shared property rights with his or her parents before marriage, or each of the borrower and the borrower’s spouse jointly owns one house with shared property rights with his or her parents before marriage), the housing found can be identified as not owned in the name of the borrower’s family members. If the borrower has not yet get married and shares no more than one house with shared property rights with his or her parents, the housing found can also be identified as not owned in the name of the borrower’s family members.

Before identifying the housing unit count, the loan acceptance institution shall confirm the housing registration information in the name of the family members of the borrower who makes an application for housing provident fund loans through a query to the housing status information center of Shanghai. The house with shared property rights owned by the borrower or the borrower’s spouse and his or her parents shall be registered earlier than the borrower’s marriage registration.

5. The applicant’s family shall be limited to the applicant, his or her spouse, and their minor children.

II. Down Payment Proportion:

1. For purchasing the first home, the minimum down payment proportion shall be 20%.

2. For purchasing the second improved housing, the minimum down payment proportion shall be 25%. If the housing purchased on loan is located in Lin-gang Special Area of China (Shanghai) Pilot Free Trade Zone and throughout the six administrative districts of Jiading, Qingpu, Songjiang, Fengxian, Baoshan and Jinshan, the minimum down payment proportion shall be 20%.

3. For an application for a combination loan, the down payment proportion requirements for commercial loans in the combination loan shall also be met.

III.Loan Quota:

The quota of housing provident fund loan shall also meet the following quota standards:

1. Not exceeding the loan quota determined by the multiple of the housing provident fund account balance of the loan applicant and the joint loan applicant (the multiple of the basic housing provident fund account balance shall be 30 times, and the multiple of the supplementary housing provident fund account balance shall be 10 times);

2. Not exceeding the remaining total house price after deducting the down payment amount at a prescribed proportion;

3. Not exceeding the loan quota determined by the repayment capacity of the loan applicant and the joint loan applicant (the monthly principal repayment of the housing provident fund loan by the loan applicant and the joint loan applicant shall not account for more than 40% of the monthly salary base);

4. Not exceeding the maximum loan quota in Shanghai:

(1) For those purchasing the first home, the maximum individual loan quota shall be RMB 650,000, and the maximum family loan quota shall be RMB 1.3 million;

(2) For those purchasing the second improved housing, the maximum individual loan quota shall be RMB 500,000, and the maximum family loan quota shall be RMB one million;

(3) For those contributing to the supplementary housing provident fund, the maximum individual loan quota shall be increased by RMB 150,000 based on the above quota, and the maximum family loan quota shall be increased by RMB 300,000 based on the above quota;

(4) For multiple-child families in compliance with China’s childbearing policy, if they purchase the first home in Shanghai and have at least one minor child at the time of application for housing provident fund loans, the maximum loan quota (including the maximum loan quota for the supplementary housing provident fund) shall be increased by 20% based on the current maximum quota of the housing provident fund loan in Shanghai, that is, the maximum individual loan quota shall be RMB 780,000, and if they contribute to the supplementary housing provident fund, the maximum loan quota shall be increased by RMB 180,000 based on the said quota; the maximum family loan quota shall be RMB 1.56 million, and if they contribute to the supplementary housing provident fund, the maximum loan quota shall be increased by RMB 360,000 based on the said quota.

5. Other factors that affect the loan quota.

IV. Loan Term:

The maximum loan term shall be the shortest of the following:

1. The maximum term of the housing provident fund loan shall not exceed five years after the applicant’s statutory retirement age (statutory retirement age: 60 years old for males and 55 years old for females);

2. For purchasing the first-hand housing, the term of the housing provident fund loan shall not exceed 30 years;

3. For purchasing the second-hand housing:

(1) If the age of the house purchased is less than 20 years, the term of the housing provident fund loan shall not exceed 30 years;

(2) If the age of the house purchased is between 20 years (including 20 years) and 35 years, the term of the housing provident fund loan shall not exceed the difference obtained by subtracting the housing age from 50 years;

(3) If the age of the house purchased is 35 years or above, the term of the housing provident fund loan shall not exceed 15 years.

V. Loan Interest Rate:

The interest rate for housing provident fund loans shall be implemented in accordance with the interest rates announced by the People’s Bank of China and the differentiated housing provident fund loan policies.

VI. Repayment Methods:

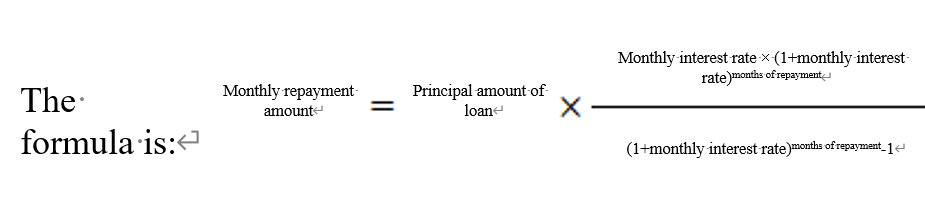

1. Monthly equal principal and interest repayment method: The borrower shall repay a fixed total amount of loan principal and interest every month, but repay more and more loan principal and less and less interest in the monthly repayment amount on a monthly basis.

2. Monthly equal principal repayment method: The borrower shall repay a fixed amount of principal every month, but repay less and less loan interest month by month.

Individual Housing Provident Fund Loan Quota, Down Payment, and Interest Rate Policy

Housing Purchased | First Housing | Second Improved Housing | ||||

Borrowing Family | One Borrower | Two or More Borrowers | One Borrower | Two or More Borrowers | ||

Childless or One-child | Multi-child | Childless or One-child | Multi-child | |||

Housing Provident Fund Max. Loanable Amount (in RMB) | 650,000 | 780,000 | 1.3 million | 1.56 million | 500,000 | 1 million |

Supplementary Housing Provident Fund Max. Loanable Amount (in RMB) | 150,000 | 180,000 | 300,000 | 360,000 | 150,000 | 300,000 |

Total Loanable Amount (in RMB) | 800,000 | 960,000 | 1.6 million | 1.92 million | 650,000 | 1.3 million |

Rate of Down Payment | The minimum rate of down payment is 20%. | 1. The minimum rate of down payment is 25%; 2. The minimum rate of down payment is 20% if the housing purchased is in Lin-gang Special Area, and Jiading, Qingpu, Songjiang, Fengxian, Baoshan, and Jinshan districts. | ||||

Loan Interest Rate | Shorter than five-year period (included): 2.35%; Longer than five-year period: 2.85%. | Shorter than five-year period (included): 2.775%; Longer than five-year period: 3.325%. | ||||