Communique on Execution of Shanghai Housing Provident Fund System for Year 2012

(Reviewed and approved on 3rd April 2013 by 37th Plenary Congress of Housing Provident Fund Management Committee of the Municipality)

We hereby issue Communique on Execution of Shanghai Housing Provident Fund System for Year 2012 as follows, pursuant to the stipulations under article 32 of the State Council’s Regulations on Management of Housing Provident Fund and article 14 of Provisions of Shanghai Municipality on Administration of Housing Provident Fund.

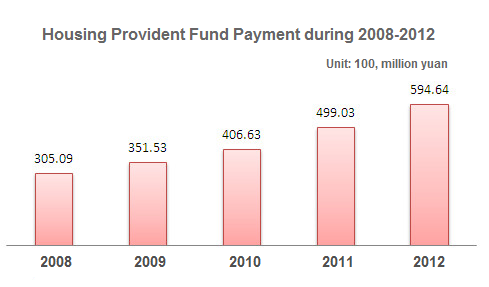

1. Housing Provident Fund Payment

The Municipality’s housing provident fund payment rate in 2012 was 7% for both units and employees, with additional housing provident fund payment rates both ranging from 1% to 8%.

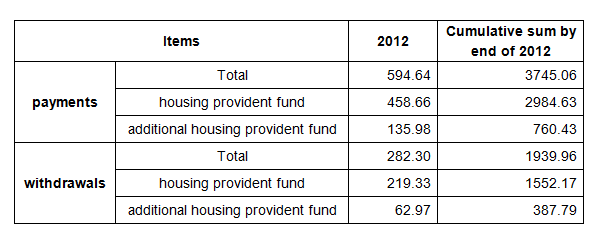

The payment amount of housing provident fund and additional housing provident fund in 2012 was 59.464 billion yuan, up 19.16% year on year, comprising 45.866 billion yuan housing provident fund and 13.598 billion yuan additional provident fund. By end of 2012, the total payment amount of housing provident fund and additional provident fund registered 374.506 billion yuan.

The number of the Municipality’s housing provident fund paying employees by end of 2012 edged up to 4.8758 million, a gain of 0.374 million from end of 2011. Additional housing provident fund reported 1.0522 million paying employees, up 0.0748 million from end of 2011.

2. Housing Provident Fund Withdrawal

Withdrawal of housing provident fund and additional housing provident fund in 2012 amounted to 28.23 billion yuan, up 17.42% year on year, comprising 21.933 billion yuan housing provident fund and 6.297 billion yuan additional housing provident fund. Annual withdrawal of housing provident fund and additional housing provident fund due to repayment of home buyer loans reached 19.265 billion yuan. Withdrawal of housing provident fund and additional housing provident fund due to home purchase (one-off withdrawal) and housing renting registered 2.033 billion yuan. Those two categories of withdrawal added up to 21.298 billion yuan, accounting for 75.44% of the total withdrawal. Withdrawal due to retirements and domicile changes recorded 6.932 billion yuan, assuming 24.56% of the total withdrawal amount.

In 2012, 500 million yuan housing provident fund was withdrawn, approximately 16000 person-times, in line with policies on items such as withdrawal of housing provident fund due to property service charge or rent, withdrawal due to purchase of joint-ownership security housing (affordable housing) preceding borrowing and withdrawal of housing provident fund due to loans repayment via housing provident fund accounts for borrowers of not-yet-commissioned commercial banks.

By end of 2012, the cumulative withdrawal of housing provident fund and additional housing provident fund by employees of the Municipality registered 193.996 billion yuan.

Housing Provident Fund Payments vs. Withdrawals

Unit: 100,million yuan

3. Housing Provident Fund Loans

(1) Home buyer loans

In 2012, housing provident fund loans issued for home purchase amounted to 41.038 billion yuan, accounting for 111800 households, up 54.83% and 52.52% respectively from the previous year, including 4.11 billion yuan home buyer loans for 16300 households’ affordable housing, 12.9-fold and 13.6-fold rise from the previous year respectively. By the end of 2012, a cumulative 300.86 billion yuan housing provident fund loan had been issued to 1.6753 million households for home purchase, with a cumulative building area of 152 million square meters.

In 2012, collection of housing provident fund home purchase loans was normal, with a total principal of 19.299 billion yuan collected. By the end of 2012, a cumulative principal of 158.81 billion yuan had been collected for the housing provident fund home buyer loans, with a loan balance of 142.05 billion yuan, accounting for 712900 households’ outstanding loans.

The year 2012 witnessed fairly good risk control of housing provident fund home buyer loans. At the end of 2012, the overdue rate for three or more installments in terms of household number was 1.14‰, and the overdue rate in terms of the payment amount was 0.09‰.

(2) Loans in Support of Security Housing Construction

2.38 billion yuan mortgage loans was issued in 2012 for pilot security housing projects of the Municipality, with a cumulative 3.032 billion yuan mortgage loans issued for the pilot projects by end of the year, comprising 1.306 billion yuan for relocation housing projects for shanty towns reconstruction, 1.431 billion yuan for public rental housing projects and 0.295 billion yuan for joint-ownership security housing projects.

4. Housing Provident Fund Financial Status

(1) Assets and Liabilities

At the end of 2012, total housing provident fund was 202.855 billion yuan, including 47.368 billion yuan housing provident fund deposit, 6.515 billion yuan value-added proceeds deposit, 578 million yuan interests receivables, 3.312 billion yuan other account receivables (with 3.265 billion yuan from low-rent housing and public rental housing), 145.082 billion yuan commissioned loans (with 142.05 billion yuan home purchase loans and 3.032 billion yuan loans in support of security housing construction projects).

At the end of 2012, total housing provident fund liabilities and net assets amounted to 202.855 billion yuan, including 180.51 billion yuan housing provident fund, 2.128 billion yuan interests payables, 332 million yuan other account payables, 6.826 billion yuan supplementary fund for urban low-rent housing construction, and 13.059 billion yuan loan risks reserved fund.

(2) Value-added Proceeds

Various service revenues of housing provident fund in 2012 totaled 7.722 billion yuan, including 1.362 billion yuan deposit interests income, 6.281 billion yuan loans interests income, 58 million yuan national debt interests income, and 21 million yuan other incomes. Various service expenses recorded 4.195 billion yuan, including 3.853 billion yuan interests payment to the fund payers, 117 million yuan commission payment due to the collection, 199 million yuan loan commission payment, and 26 million yuan other expenses payment. Annual value-added proceeds reached 3.527 billion yuan.

(3) Value-added Proceeds Distribution and Use

According to the provisions in the State Council’s Regulations on Management of Housing Provident Fund and Ministry of Finance’s Methods for Financial Administration of the Housing Provident Fund, of the housing provident fund proceeds in 2012, withdrawal of loans risks reserved fund amounted to 2.211 billion yuan, withdrawal of administrative overheads registered 72 million yuan (including 38 million yuan special overheads for the information system construction & maintenance and the operation of service outlets in the municipality), and withdrawal of supplementary fund reported 1.244 billion yuan for construction of the city’s low-income families rental housing.

1.201 billion yuan housing provident fund was used in the city’s subsidized housing program in 2012 for low-income families rental housing and public rental housing as approved by the central government, including 0.015 billion yuan for low-income families rental housing decoration and 1.186 billion yuan for public rental housing purchase and decoration.

5. Major Achievements:

(1) Policy Adjustment

Housing provident fund home loans policies, strictly abiding by housing macro-regulatory policies of the state and the municipality, closely restricted and contained investment and speculation targeted demand as well as shored up primary home and improvement-oriented housing demand.

Withdrawal policies were further streamlined, prompting institution and enforcement of policies such as Trial Measures on Low-income Needy Families’ Withdrawal of Housing Provident Fund due to Property Service Charges, Operation Procedures for Borrowers of Not-Yet-Commissioned Banks of the Municipality Applying for Withdrawal of Housing Provident Fund due to Repayment of Home Buyer Loans, to further extend the application scope of housing provident fund withdrawal.

(2) Housing Provident Fund System Coverage Expansion

Publicity means and enforcement measures were employed simultaneously, to conduct special enforcement action in tandem with implementation of Measures on Housing Provident Fund Administrative Enforcement Management, with coalition of the municipality and the district focusing on a proportion of the units that failed to make payment or had made inadequate payment of housing provident fund, as well as step up efforts to publicize housing provident fund system by fresh new advertising means of housing provident fund cartoon show on media. A total of 1215 units were reviewed and inspected for enforcement compliance, and administrative penalties imposed on 3 units.

(3) Support for Security Housing Construction

Housing provident fund continued to shore up security housing construction by loaning balance of the fund, and managed to make investment of housing provident fund’s value-added proceeds in public rental housing purchase of 1.1 billion yuan worth of Jing Hua Fang as approved by the management committee, following successful operation of Shang Jing Fang. The second batch of housing provident fund mortgage loans for security housing projects was endorsed in 2012 by the three ministries of the state including Ministry of Housing & Urban-Rural Development, amounting to 11.362 billion yuan. 2.38 billion yuan loans was issued as of end of December.

(4) Information Technology Development

Unremitting effort was made to boost application level disaster recovery backup system development. Proposal for the project of application level disaster recovery backup system for housing provident fund information system of the municipality had passed the project initialization procedure after reviewed by the authorities such as Construction and Transportation Commission, Development and Reformation Commission and Economic Information Commission of the municipality. Scheduled attempts and progress were made in top-down design of the computer system. Accommodative measures were taken to launch the construction of housing provident fund’s history data information system jointly with China Construction Bank. Access to Cyberspace Service Hall was created on the home page, alongside debut of the website’s English version and smart phone application ready for service.

(5) Service Enhancement

In the service-focused year 2012, a series of new service measures were taken, including promoting online payment and commissioned deduction to optimize housing provident fund payment means and gradually expanded CCB’s review service outlets for more convenience of vast paying units, extended working time, with some outlets opening six days a week to provide weekend services, and spearheaded the launching of Hotline 12329 service amid the nationwide campaign, providing incessant human voice or automatic voice services seven days a week.

Shanghai Provident Fund Management Center

April 2013